Esg in gaming: the corporate value of sustainability

Sustainability has garnered a lot of attention in recent years. ESG (environmental, social, and governance) in gaming was the topic of a presentation delivered by Rachel Decelis, Senior Manager on ESG at KPMG in Malta, at the recent SBC Summit in Barcelona.

Rachel explained that ESG is closely linked to the United Nations Sustainable Development Goals, which were adopted globally in 2015 with a target date of 2030. The driving forces of ESG include climate change, societal pressures (including changing consumer preferences as well as capital markets) and regulatory pressures, both within the European Union and outside it – including in the US and China. A clear example of that is the Corporate Sustainability Reporting Directive (CSRD), which will apply to all large companies and groups and listed companies, starting from the year 2024.

How can ESG add value to the gaming sector?

Looking at gaming companies’ ecosystem, Rachel described how ESG can be a differentiating factor in customers’ minds, considering that data shows that many customers are becoming better informed about sustainability and are willing to pay a premium for sustainable products. From an employee perspective, she explained that research from McKinsey shows that diverse executive teams perform better: companies in the top quartile for gender diversity are 25% more likely than those in the fourth quartile to outperform on financial profitability. These statistics present an opportunity for the sector, which is still male dominated (with some notable exceptions at leadership level) to reflect on what more can be done to attract women to the industry, and to ensure that their work environment enables them to flourish and progress.

In terms of capital markets, the Chartered Financial Analyst (CFA) Institute in 2018 issued guidance on the integration of ESG risks, mindful that ESG can affect future cash flows. Research by the CFA Institute in 2017 shows that ESG issues are integrated by investors in their analysis between 35 and 56% of the time – therefore gaming companies are more likely to find investors if they report on their ESG metrics as well as improve on them. Rachel also highlighted how the issue of ESG performance and ESG premia is a frequent topic of the conversations KPMG is having with banks, with banks looking at differentiating between companies that are operating more sustainably and those that aren’t – and incentivising those that do.

Considering that gaming partners and suppliers face the same pressures, it makes sense that they would want to work with operators and affiliates who operate ethically and in line with ESG values and principles.

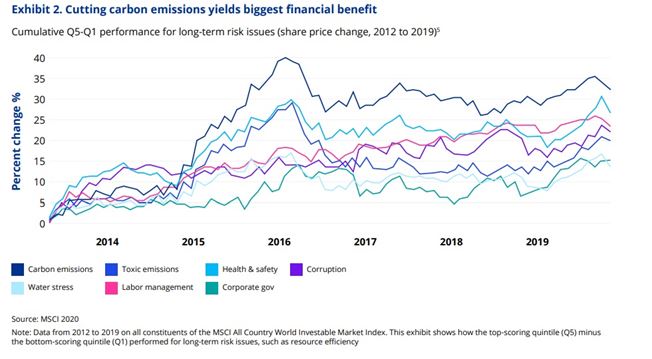

Rachel also showed data from the MSCI All Country World Investable Market Index demonstrating that the share price of companies who performed better on ESG factors was significantly better over a five-year period compared to that of companies who performed worse.

How can gaming companies implement ESG in practice?

ESG is wide and deep, not least in this sector, and conducting a materiality assessment is a crucial step for gaming companies starting their ESG journey. Rachel described how KPMG’s own research has shown that in their ESG strategy and reporting, gaming companies tend to prioritise responsible gaming, player protection and support for at-risk customers. This is closely followed by data security and customer privacy, employee diversity, inclusion and equal opportunity, as well as anti-money laundering. Unfortunately, few gaming companies are prioritising carbon emissions, perhaps because they do not see it as highly relevant to the sector. However, gaming creates a demand for carbon emissions, such as through data centres and business travel. This makes it critical for gaming companies to look at how they can reduce their organisation’s wider carbon footprint, such as by requiring that data centres use renewable energy.

Rachel recommended that companies looking to take sustainability seriously start by communicating their top leadership commitment, and by assigning responsibility for ESG to a senior person within the firm who can drive the ESG agenda. Initially, ESG may start by being compliance-driven, but companies who embed ESG into their strategy and ultimately use it to drive their purpose can find that ESG can be leveraged to create value.

She concluded by stating that companies that take the lead on sustainability may well find themselves at an advantage, being better prepared to meet stakeholder and regulatory expectations, and better able to survive and thrive in these changing times.